washington county utah sales tax

To review the rules in Utah visit our state-by-state guide. Or visit our Utah sales tax calculator to lookup local rates by zip code.

5 rows The 675 sales tax rate in Washington consists of 485 Utah state sales tax 035.

. If you need access to a database of all Utah local sales tax rates visit the sales tax data page. Has impacted many state nexus laws and sales tax collection requirements. 2019 Tax Sale.

This page lists the various sales use tax rates effective throughout Utah. Average Sales Tax With Local. Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Washington County CoCity 27000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option Liquor Restaurant Sales Short-term Leasing Transient Room Addl Transit.

6 rows The Washington County Utah sales tax is 605 consisting of 470 Utah state sales tax. Washington County collects on average 051 of a propertys assessed fair market value as property tax. 2022 Utah Sales Tax By County Utah has 340 cities.

These buyers bid for an interest rate on the taxes owed and the right to. State Local Option. Washington County UT currently has 174 tax liens available as of February 11.

Automating sales tax compliance can help your business keep compliant. Utah State Tax Commission Standard of Practice 12 Real Property Billing and Collecting See Section XIIV Tax Sale pgs 16-25. One of a suite of free online calculators provided by the team at iCalculator.

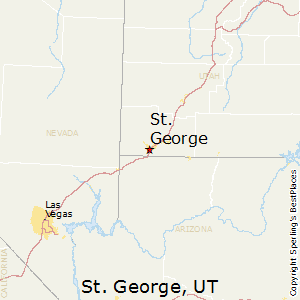

Notice is hereby given that on May 28 2020 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale. A county-wide sales tax rate of 16 is. George UT 84770 435 634-5703.

Washington County in Utah has a tax rate of 605 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Washington County totaling 01. Utah County ClerkAuditor - Tax Sale Location. See how we can help improve your.

2021 Tax Sale. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Washington County UT at tax lien auctions or online distressed asset sales. We want the content of our website to be timely and useful to you.

59-2-1331 Property tax due date -- Date tax is delinquent -- Penalty -- Interest -- Payments -- Refund of prepayment. 3 rows Washington County UT Sales Tax Rate The current total local sales tax rate in. The Washington County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Washington County Utah in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Washington County Utah.

Tom Durrant 87 North 200 East STE 201 St. The Utah state sales tax rate is currently 485. Utah has state sales tax of 485 and.

The current total local sales tax rate in Washington UT is 6750. If you dont find what you need here please let us know. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

See section 21-5 Real Property Tax Sale Procedures. Utah is ranked 1131st of the 3143 counties in the United States in order of the. 2020 Tax Sale.

The Washington County Sales Tax is 16. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Treasurer stops accepting redemption payments for properties listed for sale.

The median property tax in Washington County Utah is 1231 per year for a home worth the median value of 240900. The 2018 United States Supreme Court decision in South Dakota v. Notice is hereby given that on May 20 2021 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale.

Thursday May 19 2022 - Live Auction Limited Sale of Delinquent Properties - Preferred Bid and Undivided Interest Sales Only. 051 of home value. The Washington County Treasurers office is pleased to offer a range of helpful information for the taxpayers of Washington County.

Notice is hereby given that on May 23 2019 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale. Yearly median tax in Washington County. The Washington County sales tax rate is 16.

The December 2020 total.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Residential Exemption Washington County Of Utah

How Do State And Local Sales Taxes Work Tax Policy Center

Geologic Hazard Maps For St George Hurricane Area Utah Geological Survey

Utah Sales Tax Small Business Guide Truic

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Utah Property Tax Calculator Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Washington County Or Property Tax Calculator Smartasset

Utah Sales Tax Rates By City County 2022

Payment Options Washington County Of Utah

Washington County Utah Bans Unhosted Short Term Rentals

How Healthy Is Washington County Utah Us News Healthiest Communities

Utah Government And Society Britannica